Money Management Process

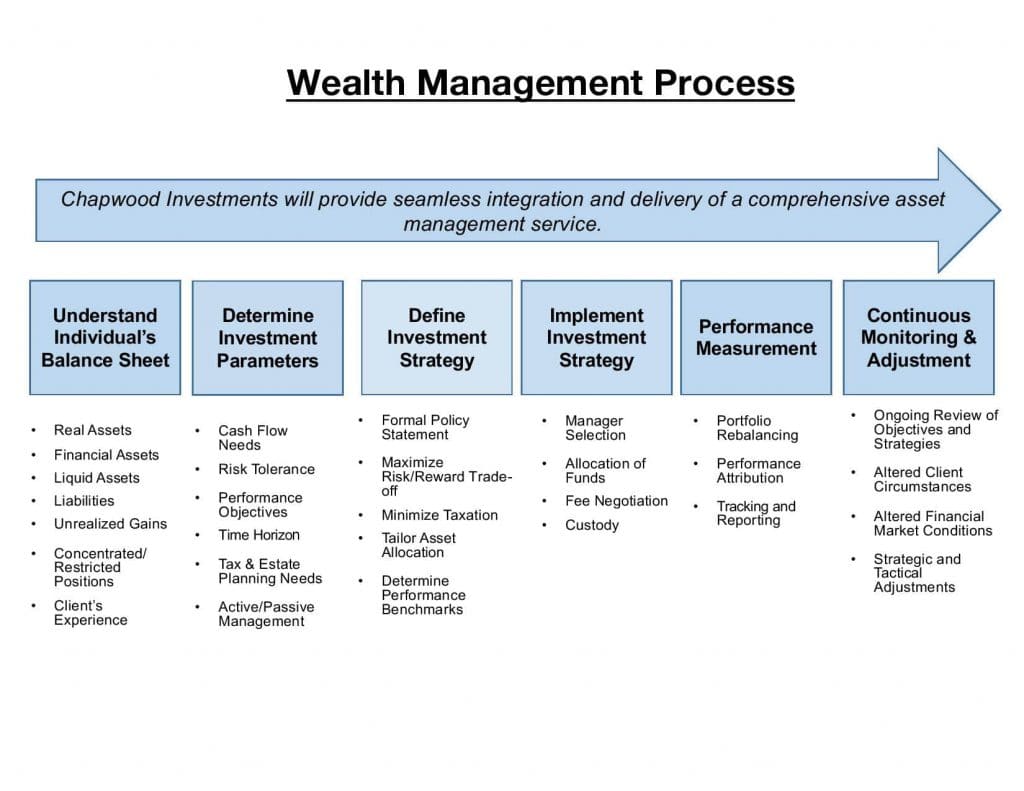

Money management is not just about picking stock or bonds. It’s a real process! And we like to think our process is what sets Chapwood Investments apart from our competitors in our industry.

Our approach to money management ignores the narrow approach of attempting to beat individual markets’ performance and applies a much broader devising strategy method.

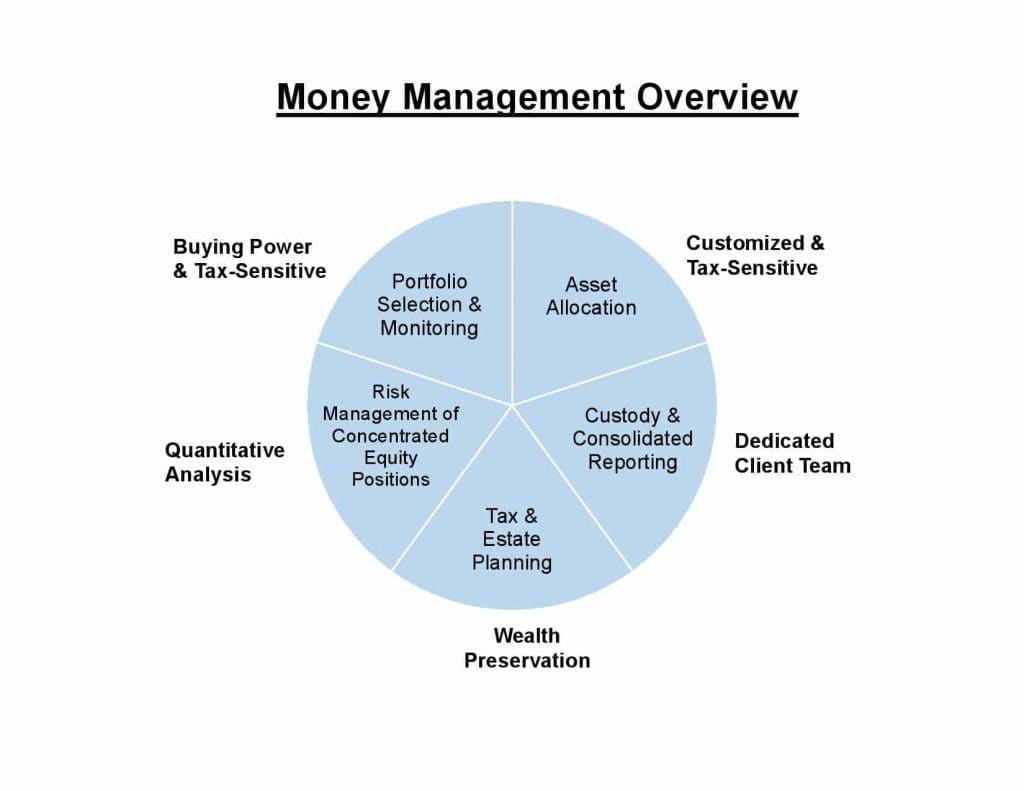

If you take a look at our Money Management Overview, there are several broad categories to help you understand our processes more transparent, including:

Dedicated Client Team: Our Dedicated Client Team puts together detailed reports for Custody & Consolidated Reporting analysis. We’re prepared to explain any report from your quarter-to-date and year-to-date returns and even up to the day we are asked.

Wealth Preservation: Our Family Office is an organization that supports the overall financial needs and objectives of a family, especially when it comes to Wealth Preservation. We work closely with your state attorney and CPA to meet your tax and estate planning needs, no matter what life may hand you.

Quantitative Analysis: When a significant portion of your investment gets tied up in the stock of a single company, it presents both opportunity and risk. We can help you navigate these uncertain times.

Buying Power & Tax-Sensitive: Above all else, there’s nothing more important than making sure you’re aware of how you’re doing and making sure that you know how we’re doing. We promise to guide you through Portfolio Selection and to monitor continuously.

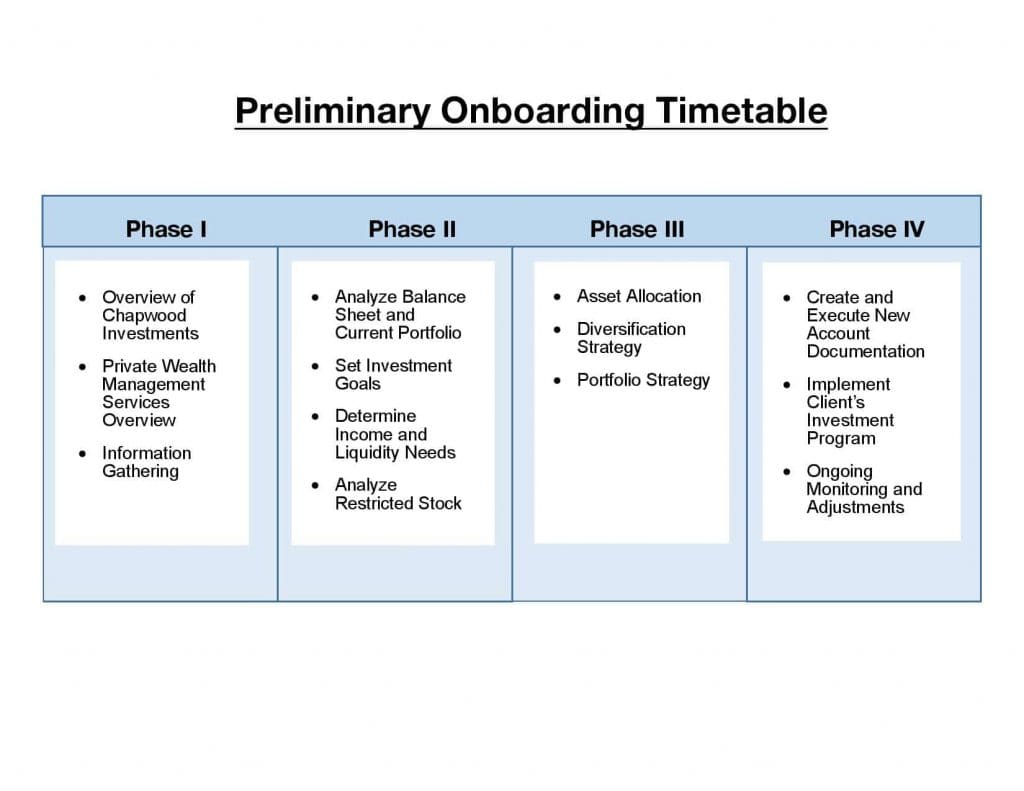

Preliminary Onboarding Timetable

At Chapwood Investments, LLC, we are concerned with investment analysis, portfolio design, and portfolio performance evaluation. These methods express our views regarding risk and its relationship to investment return quantitatively. They focus attention on the overall composition of the portfolio rather than the traditional process of analyzing and evaluating the individual components.

As your Investment advisor, we can examine, and design portfolios predicated on risk-reward parameters and identify and quantify portfolio objectives.

To achieve this goal, let’s take a walk through our four-phase preliminary onboarding timetable:

Goals for Phase I:

Right off the bat, we like to show our clients how we approach things at Chapwood Capital Investments, LLC. We believe that we are very different in our investment forensic and how we approach analyzing what you currently own. Our Private Wealth Management Services are as healthy as any firm, including the bulge bracket firms. In fact, we compete very vigorously against Morgan Stanley, UBS, Merrill-Lynch, and Goldman Sachs.

One effective way we separate ourselves from competitors is through information gathering. We don’t just get the basic information. We pride ourselves on going above and beyond when gathering information by digging deep into your current and future goals.

Additionally, we do not let you accept what the CPI number is. We talk about the Chapwood Index, and most importantly, what your real cost of living increase is.

Goals for Phase II:

Here, it’s time to take a further look into your Analyze Balance Sheet and Current Portfolio.

Additionally, we will take a step to write your Investment Policy statement carefully. Like most big institutional firms, you must have a “roadmap” to achieve your financial goals.

Understand that when chapwood investments reviews your portfolio it’s done with care, no matter where you’re at on your journey in life. However, we like to determine income and liquidation needs in case life gets in the way. For example, you might need money from these accounts or may want to make investments away from us.

Also, if you have restricted stock, we will look at the best way to reduce some of your exposure, need be.

Goals for Phase III:

Asset allocation is the key to portfolio management, but it’s really about the low correlation that asset allocation needs to bring to you. So, we spend time with you to talk about diversification strategies. This will help us identify how we provide our portfolio builder services and where the correlations are very, very low.

Goals for Phase IV:

We are always monitoring what we’re doing and what we can do better to serve you. This is why in phase IV, we ask hard questions to make sure what we are doing is working for you. Some questions might include, have your goals changed? Is the investment program working? We want to make sure we are building a good relationship with you, which happens during onboarding.

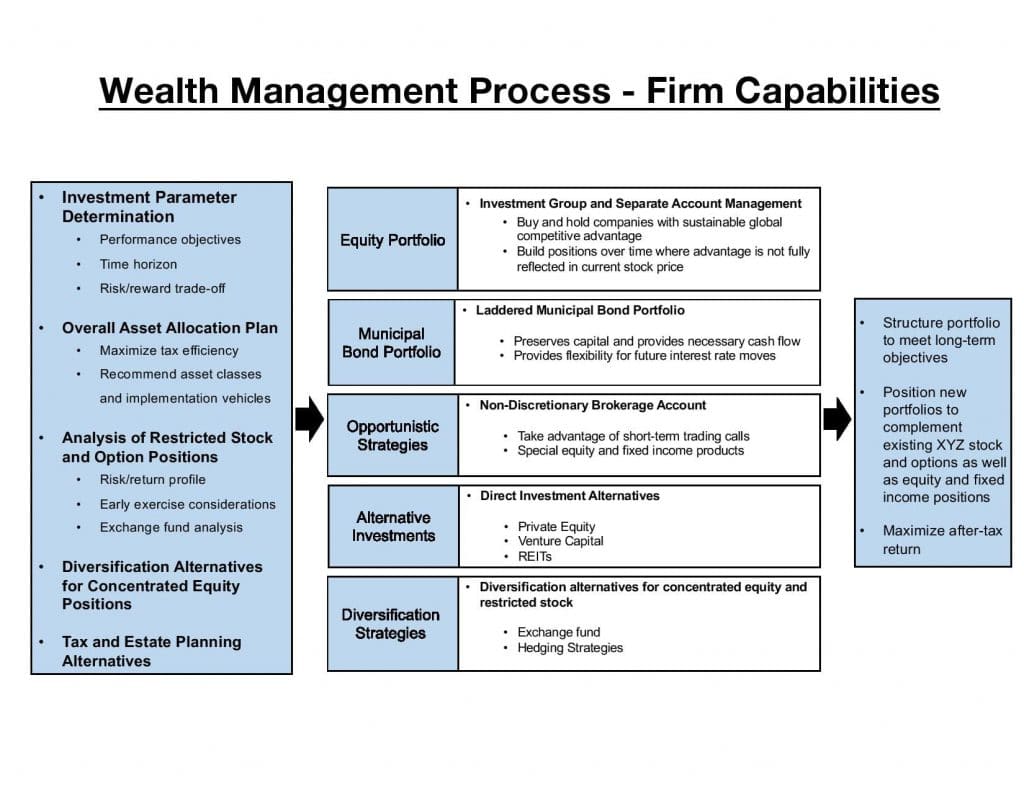

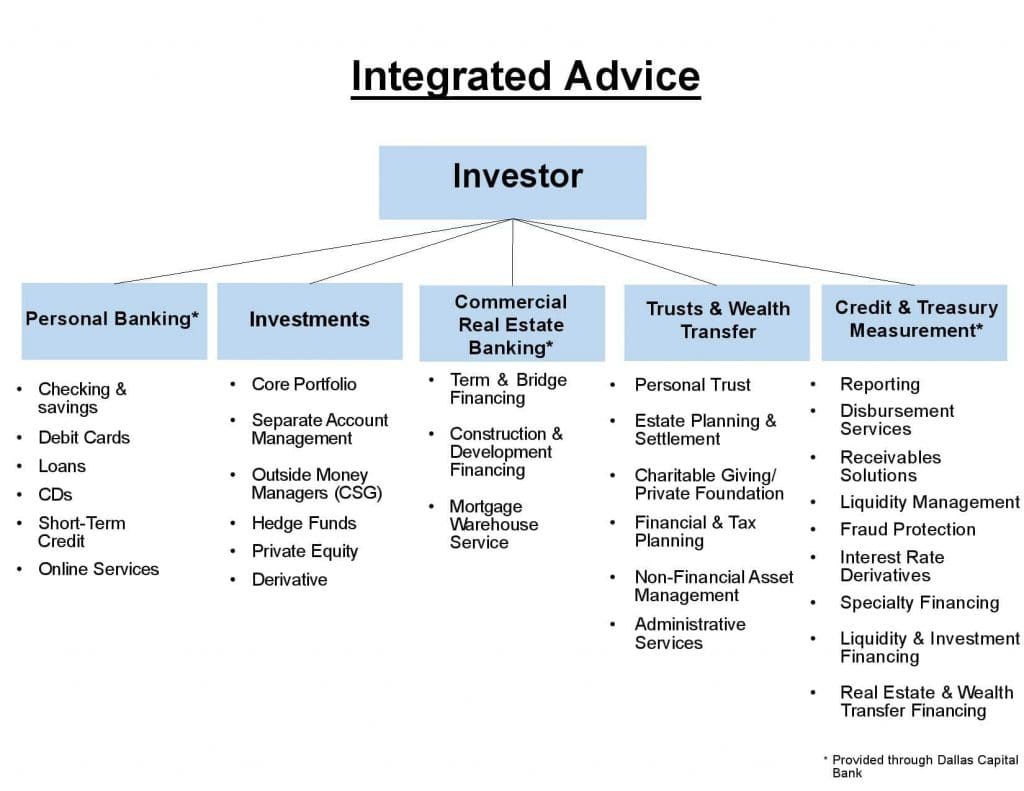

Integrated Advice

We work across several departments to provide holistic financial services that put you first. No more running around or hunting for solutions. True collaboration sits at the core of our work.

At Chapwood Capital Investments, LLC, we’ve crafted truly integrated advice. Offering versatile services across several divisions – provided by a skilled team, bonded together by a single goal to meet your unique needs.

From personal banking to Credit & Treasury Measurement, our collaborative partners work hard to save you time and money.

Let us put you in touch with the following services:

- Personal Banking

- Investments

- Commercial Real Estate Banking

- Trusts & Wealth Transfer

- Credit & Treasury Measurement