In a split second, messages, photos, links, and just about anything can be shared from one part of the globe to another. In an age where information is entirely accessible to the vast population, opinions are now readily available as well. When it comes to investing, this may not be so great…

There is a popular strategy among more advanced investors known as a “contrarian” strategy. Essentially, these investors do the exact opposite of what the crowds are doing because they believe that by the time the masses catch wind of the news, the opportunity has already passed.

We may face a similar predicament with social media. In 2023, various personalities have quit their jobs and become “financial gurus” on social media platforms, ranging from TikTok to YouTube. While not all investment advice provided online is inherently detrimental, one must consider the source and the motives behind the production. Recently, there has been a rash of issues involving “pump and dump,” where celebrities, endorsers, and other influencers speak highly about a fund only to sell it at its peak, leaving newer investors picking up the pieces.

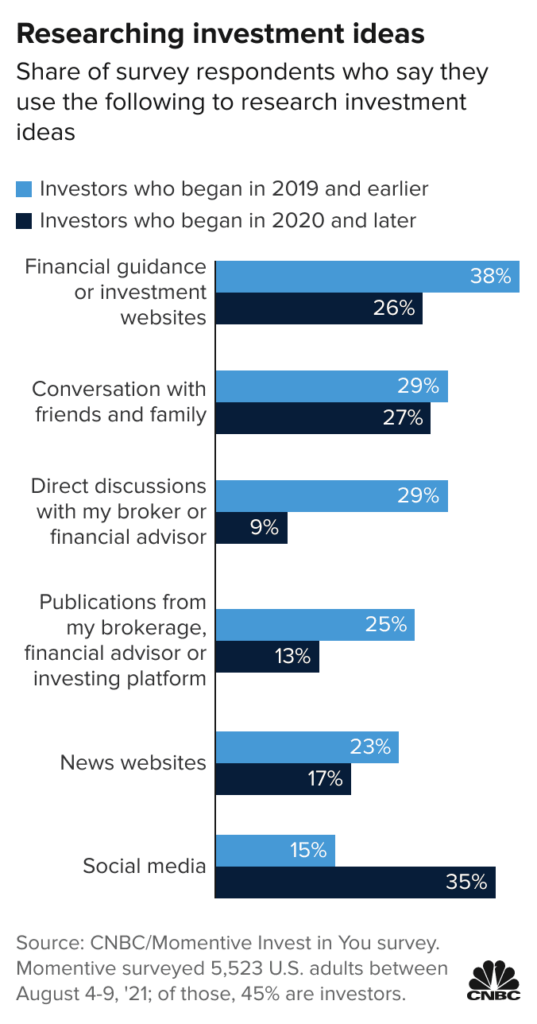

Take a look at this chart:

It has become quite evident that social media is a popular destination for financial advice. I understand this well, as someone who provides advice and analysis for a living. However, even I acknowledge that I can be wrong at times, which is why we rely on trusted sources to validate the data we find and have several team members to diversify our thinking.

“Investors who began after 2020” are simply following what they know best. They go to YouTube for how-to videos, check TikTok for recent trends, and visit Instagram for updated pictures. But where do you stand on this issue?

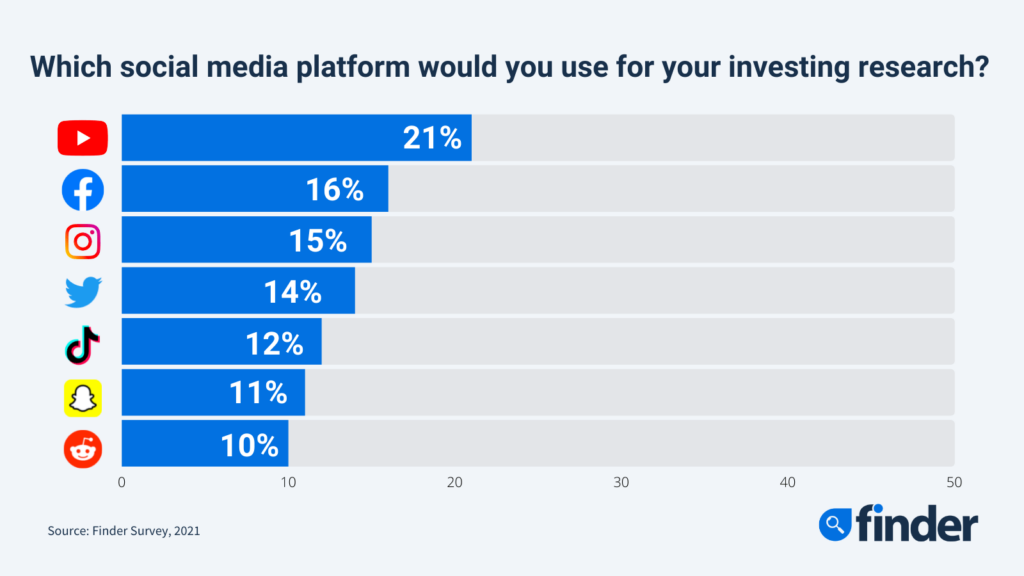

Perhaps this chart can add another dimension to the discussion:

Is one social media site more trustworthy than others? This chart seems to find YouTube to be the most visited while Facebook and Instagram round out the top 3. For what it’s worth, I have no idea who is going to Snapchat for their investment research. Perhaps they have a good friend on Wall Street they are keeping up with!

Conclusion:

In conclusion, the fusion of finance and social media presents a fascinating, yet intricate, evolution of investment practices. It’s a realm where opportunities and pitfalls coexist, demanding vigilance, research, and a discerning eye. Ultimately, the responsibility to make informed investment decisions rests with the investor, and a blend of traditional wisdom, diversified thinking, and cautious engagement with social media can help navigate this dynamic landscape.

There’s no doubt that in the era of social media, having a trusted advisor is a valuable asset when it comes to navigating the unpredictable currents of the market and the economy. For over 30 years, our firm has prioritized collaborating with accredited investors. We’re also closely monitoring the evolving landscape of social media to ensure we can provide the best guidance to our clients as they navigate these ever-changing financial waters.

If you would like to learn more about Chapwood Investments, check out the rest of our site, or feel free to reach out using my information below. I’d love to hear your opinion on social media & investing. If you just wanted to chime in or share your comments, I’m always interested in hearing others’ perspective!

Jordan McFarland

jordan@chapwoodinvestments.com