While this quote by Sir Isaac Newton doesn’t directly address financial planning, its wisdom holds true for those considering retirement.

Drawing parallels, we can gain valuable insights from the experiences of retirees who came before us. Examining their successes, mistakes, and lessons learned can offer guidance in shaping our financial plans for retirement.

Before delving into these insights, it’s crucial to recognize that individual circumstances vary, and your unique financial situation plays a significant role. However, it’s worth noting that many retirees across the country share common experiences and challenges, making these reflections relevant to a broader audience.

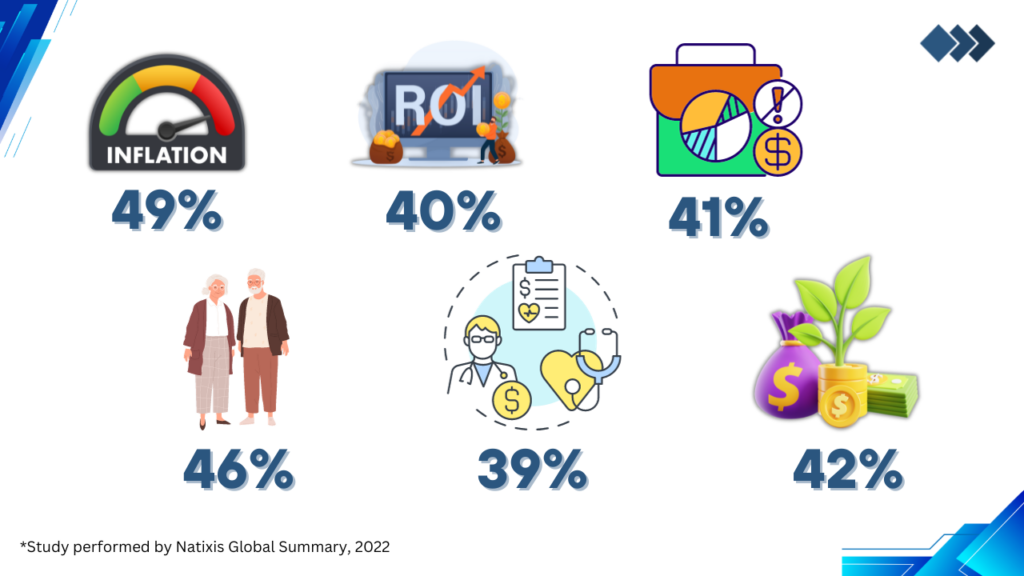

These six financial regrets, sourced from a 2022 study conducted by Natixis Global, shed light on the percentage of retirees who lamented certain decisions or missed opportunities in managing their finances leading up to and during retirement.

- Underestimating the Impact of Inflation on Their Retirement Plan (49%): Many retirees express regret over underestimating the impact of inflation on their retirement plans. Inflation erodes the purchasing power of money over time, and failing to account for its effects can result in a diminished standard of living during retirement. It is crucial to consider inflation when creating a financial strategy to ensure that your money retains its value over the long term. If you are familiar with Ed Butowsky’s investment philosophy, you may know the importance of focusing on your real rate of return which factors in inflation.

- Underestimating How Long You Will Live (46%): While perhaps a good problem to have, another common regret is underestimating one’s lifespan. With increasing life expectancy, retirees may find themselves living longer than anticipated. This miscalculation can lead to the depletion of retirement savings, making it essential to plan for a potentially longer retirement period. Accurate life expectancy estimates are crucial for ensuring financial security throughout the entirety of retirement. It is important to note that turning to annuities is not the best solution for many people here…

- Overestimating Investment Income (42%): Overestimating the returns on investments is a regret expressed by a significant percentage of retirees. While investments play a crucial role in retirement planning, it’s essential to set realistic expectations for returns. A more conservative approach to estimating investment income can help avoid disappointment and financial strain in the later stages of retirement.

- Investing Too Conservatively (41%): Some retirees regret taking an overly conservative approach to investing. While minimizing risk is prudent, excessively conservative investments may not provide the growth needed to outpace inflation and sustain a comfortable retirement lifestyle. Striking a balance between risk and return is crucial for optimizing investment performance over the long term. Remember, just because you’re taking more/less risk does not automatically mean your returns will be higher or lower.

- Setting Unrealistic Return Expectations (40%): Setting overly optimistic return expectations is another regret cited by retirees. It’s important to align return expectations with market realities and historical performance. Unrealistic expectations can lead to disappointment and may result in adjustments to retirement plans. A realistic and well-informed approach to setting return expectations is vital for effective financial planning. One issue that may come to mind for you is sequence of return risk, which is simply the possibility of experiencing poor investment performance, particularly negative returns, at the beginning of or during retirement. This phenomenon can significantly impact a retiree’s portfolio, potentially leading to a depletion of assets more quickly than anticipated and posing a greater challenge to recover from financial setbacks.

- Not Including Healthcare Costs (39%): Failing to adequately account for healthcare costs is a regret shared by a significant percentage of retirees. Healthcare expenses can escalate during retirement, and not factoring them into the financial plan may lead to unexpected financial burdens. Including a comprehensive estimate of healthcare costs is crucial for crafting a resilient retirement plan that accounts for potential medical expenses. In the same way that annuities are not the only option for one looking for assistance in not outliving their money, long-term care is not the ONLY way to prepare for healthcare costs.

In conclusion, these six common regrets voiced by retirees underscore the importance of realistic planning and proper expectations in the realm of financial management during retirement. Addressing the impact of inflation, accurately estimating one’s lifespan, and setting prudent expectations for investment income are vital components of an appropriate retirement strategy.

Balancing the level of conservatism in investment decisions and avoiding unrealistically optimistic return projections further contribute to long-term financial stability. Notably, the inclusion of healthcare costs is a critical consideration often overlooked. By learning from these regrets and integrating these insights into retirement planning, individuals can enhance their preparedness for the complexities and uncertainties associated with post-employment financial life. Ultimately, a thoughtful and comprehensive approach is key to understanding the hazard of a sequence of return risk and ensuring a more confident and fulfilling retirement.

For more info, reach out to Jordan McFarland at jordan@chapwoodinvestments.com today.

Chapwood Investments, LLC is a SEC Registered Investment Advisory Firm. No mention of a particular security, index, derivative or other instruments in this material constitutes an opinion on suitability of any security. The information and data in this material were obtained from sources deemed reliable. Their accuracy and completeness are not guaranteed. At any given time, principals at Chapwood Investments, LLC may or may not have a financial interest in any or all of the securities or instruments discussed in this material. The guests appearing in material do not receive compensation or provide endorsements or testimonials. Past performance is not indicative of any future results. Neither Asset Allocation nor Diversification guarantee a profit or protect against a loss in a declining market. They are methods used to help manage investment risk. Fixed Annuities are long term insurance contacts and there is a surrender charge imposed generally during the first 5 to 7 years that you own the annuity contract. Withdrawals prior to age 59-1/2 may result in a 10% IRS tax penalty, in addition to any ordinary income tax. Any guarantees of the annuity are backed by the financial strength of the underlying insurance company.