If you’ve been regularly contributing to your 401(k), Roth IRA, or other IRAs, you might feel frustrated by the initial slow growth in your account. Sometimes, it may seem more tempting to spend that money now to enjoy immediate benefits.

However, it’s important to understand that compounding interest operates like a slow-cooking crockpot rather than a quick-pressure cooker. Most millionaires in America build their wealth over decades, not just a few years, and certainly not months. In fact, recent studies show that the average age when people cross the “millionaire threshold” is around 49 years old.

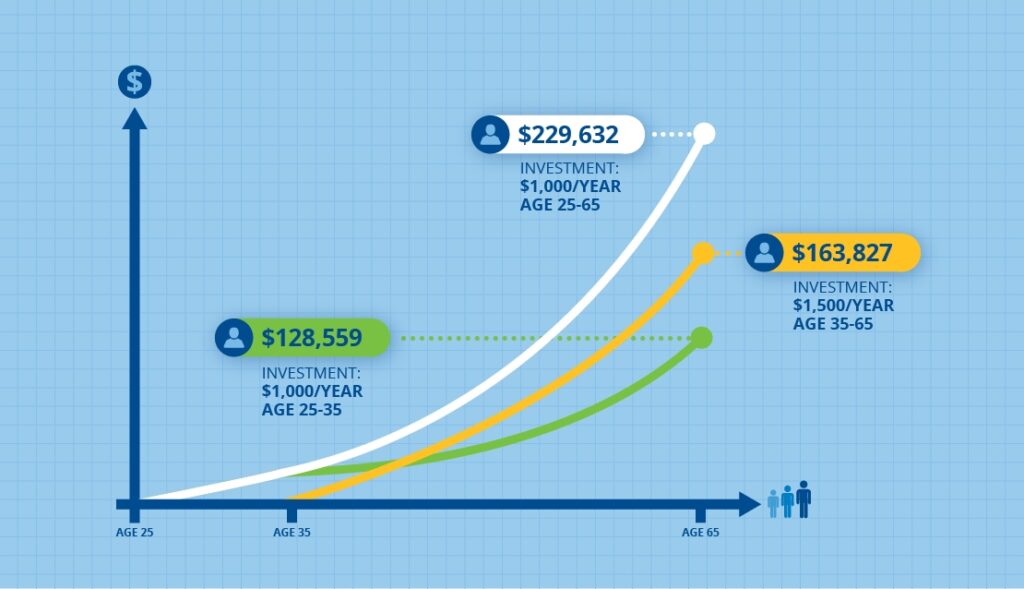

Above picture: At the beginning of our financial journey, it often feels that we are working harder than our money. By the end of our journey, it is obvious that our money is working harder than us.

In today’s video, we’ll provide a brief introduction to compound interest and explain why it’s crucial to have faith in this time-tested strategy when it comes to your investments and savings.

Summary of Video:

- Einstein has dubbed compound interest as the “eighth wonder of the world.”

- Compounding faces an enemy in volatility, as it constantly fluctuates and disrupts the growth of your investments. This is why it’s crucial to maintain a portfolio with a low VDPT. If you’re unfamiliar with VDPT, you can click here for more information.

- The Rule of 72 allows you to project how long it will take you to double your money based on a given rate of return.

In conclusion, harnessing the power of compound interest is a smart financial strategy for securing your future. While the initial growth in your retirement accounts may seem slow, it’s essential to recognize that wealth accumulation is a long-term endeavor. Like the steady heating of water that eventually boils, compound interest steadily multiplies your savings over time, often when you least expect it.

By continuing to automatically contribute to your retirement accounts, you’re essentially setting yourself up for long-term financial success. The consistency of these contributions, coupled with the magic of compounding, can lead to a substantial nest egg down the road. So, don’t be discouraged by the seemingly modest early returns. Trust in the time-tested strategy of compound interest, stay committed to your retirement savings and watch your financial future grow!

Reach out to me today at jordan@chapwoodinvestments.com if you would like to take part in our free offering of a portfolio analysis until October 1.