Ed Butowsky, Chapwood Investments, 2/16

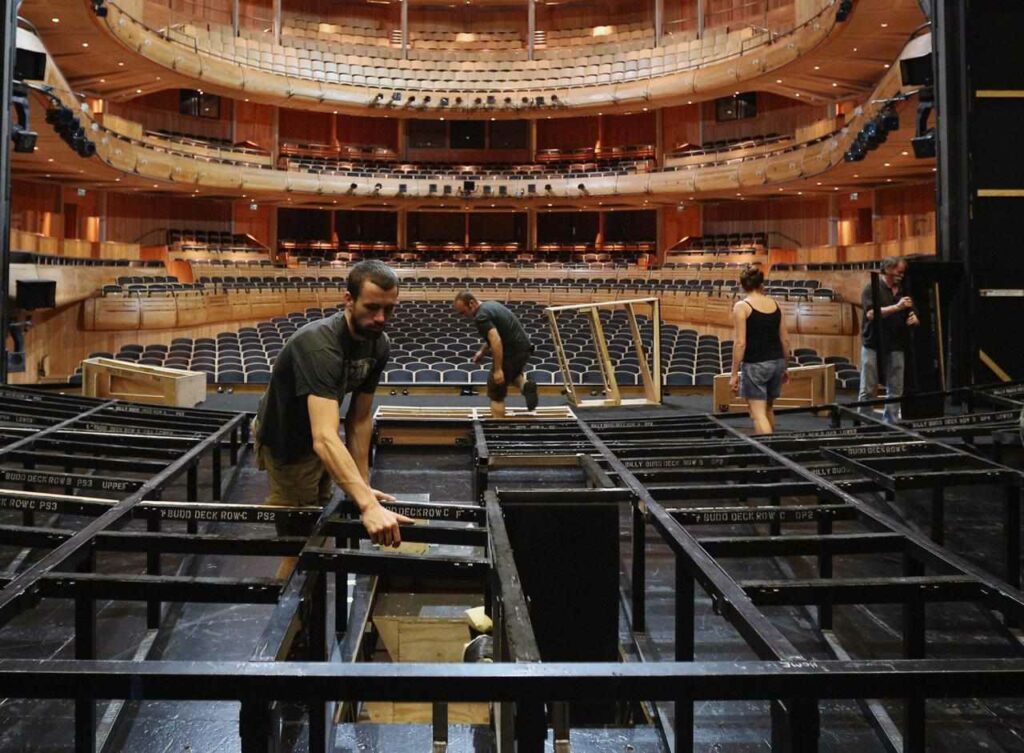

Have you ever attended a Broadway play? If so, who was your favorite character? Chances are, you did not choose a member of the backstage crew.

However, despite being overlooked, the backstage crew plays a crucial role, as we all know. While the main characters and actors bask in the spotlight and garner the most attention, it’s essential to recognize and appreciate the behind-the-scenes group for their significant contributions.

Much like the backstage crew of a play, the 10-year Treasury doesn’t receive much attention and is often overlooked from retail investors due to its limited potential for growth and its struggle to keep pace with inflation. However, like that backstage crew, the Treasury serves as a significant indicator for the entire stock market. Here are three reasons why I believe this is the case:

- Interest Rates Relationship: The yield on the 10-year Treasury is closely tied to interest rates. When Treasury yields rise, it typically indicates that interest rates are increasing, which can affect borrowing costs for businesses and consumers. Higher borrowing costs can slow down economic activity and potentially impact corporate profits, which can lead to downward pressure on stock prices. This was a BIG deal in 203 and will continue to be this year.

- Risk Perception: Investors often view US Treasuries, especially those with longer maturities like the 10-year as Ed Butowsky talks about this week, as a “risk-free” investment because they are backed by the US government. When there is uncertainty or increased risk perception in the stock market, investors may flock to Treasuries as a safe haven, driving up demand and pushing yields lower. Conversely, when investors are more confident and willing to take on risk, they may shift away from Treasuries, causing yields to rise.

- Discount Rates: The yield on the 10-year Treasury is also used as a benchmark for discount rates in financial valuation models, such as the discounted cash flow (DCF) analysis used to value stocks. Changes in Treasury yields can thus influence the valuations of stocks and other assets, impacting their prices in the market. This is a bit more technical, but still worth noting.

Let’s get to today’s video with Ed Butowsky to learn more about the importance of the 10-Year Treasury.

As mentioned above and in the video with Ed Butowsky, the 10-year Treasury might not be the flashy star in your investment portfolio, especially when you’re envisioning high-growth opportunities. After all, the treasury market is primarily seen as a safe haven for preserving capital rather than generating significant returns. It often finds itself trailing behind or grappling with the challenges posed by inflationary pressures.

Entering this year, there were high hopes pinned on the Federal Reserve and its stance on interest rates. However, the journey has been a sluggish one so far. According to Bloomberg’s measurements, the treasury market has experienced a 1.4% decline, shedding the momentum it had gathered towards the end of 2023.

In conclusion, while the US 10-year Treasury may not steal the spotlight in the world of investments, its significance cannot be overstated. Much like the steadfast beat of a metronome, it sets the rhythm for broader market movements, offering stability and serving as a crucial barometer of economic health. Despite its understated nature, the Treasury plays a vital role as a safe haven asset and a benchmark for interest rates, quietly influencing investor sentiment and financial decisions. So, while it may not be the most exciting investment, its reliability and importance cannot be overlooked.

Summary:

- The 10-year Treasury is a component of our process for valuing stocks and bonds in our clients’ investment plans.

- Inflationary pressures persist, preventing the Fed from lowering interest rates. This will likely hinder the robustness of the treasury market, leading to negative sentiment for the overall stock market.

- Ed Butowsky remains bullish, anticipating a decrease in interest rates around late spring, despite no drops so far this year. Consequently, investments such as utilities and small-cap stocks are expected to perform well.

For more info contact:

Jordan McFarland

jordan@chapwoodinvestments.com

To view the rest of our video library, click here.

To visit Ed’s NEW YouTube page, click here.

Disclosure:

Chapwood Investments, LLC is a SEC Registered Investment Advisory Firm. No mention of a particular security, index, derivative or other instruments in this material constitutes an opinion on suitability of any security. The information and data in this material were obtained from sources deemed reliable. Their accuracy and completeness are not guaranteed. At any given time, principals at Chapwood Investments, LLC may or may not have a financial interest in any or all of the securities or instruments discussed in this material. The guests appearing in material do not receive compensation or provide endorsements or testimonials. Past performance is not indicative of any future results.