It’s that time of year again when we all print off (or more likely, download) our NCAA March Madness brackets and attempt to pick the winner.

While this is a fun and unique thing we do, it’s incredibly difficult to pick the winner and some would probably say impossible to create the perfect bracket.

Today, Ed Butowsky is comparing the excitement of March Madness to the volatility of Market Madness, and how you should approach one like you do the other.

Summary:

- Diversification is important for long-term investing due to the difficulty of picking “the winners”.

- Just like it’s difficult to pick the winner of the NCAA tournament, it’s very hard to pick the top asset class and even more difficult to pick individual stocks.

- Diversification is more than simply blindly investing in multiple asset classes.

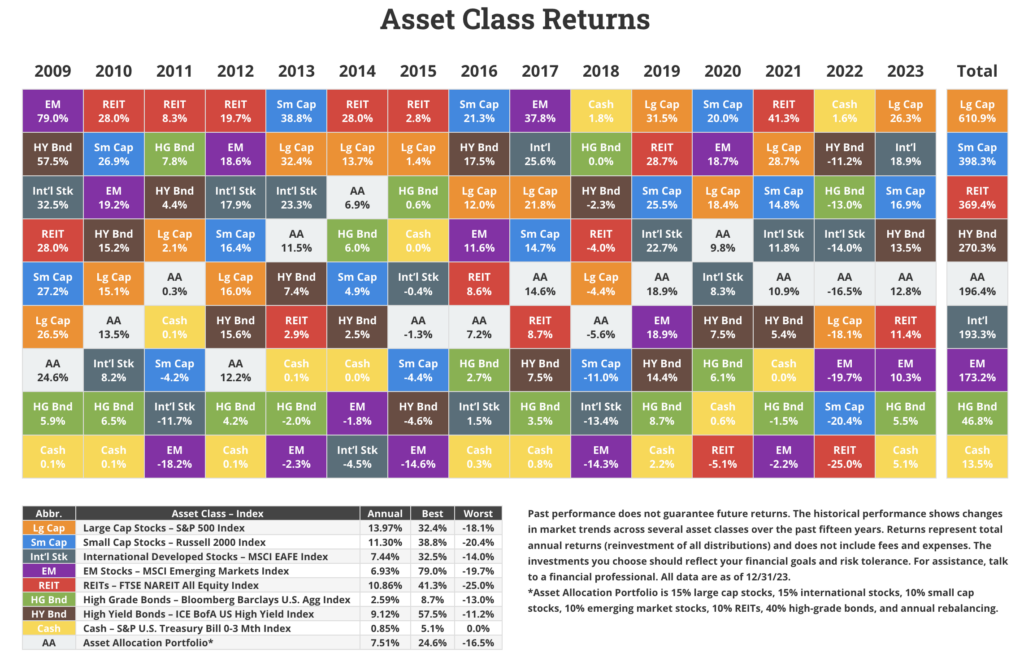

What is a quilt chart?

A quilt chart is simply a chart that shows the past returns of the different assets of the stock market.

About 90% of the success of your investment portfolio will come from asset allocation. This is important to know because unlike March Madness, your success will come from choosing to diversify rather than pick one big winner.

In the video, Ed mentioned the importance of considering the quilt chart.

A Few Thoughts on Picking Winners

As you can see, it is rare for there to be back-to-back winners. In the case of REITs, in the years they do claim the consecutive return “wins“, they perform poorly the in the following years.

Here in lies the main issue with picking winners regardless of if it’s March Madness, asset classes, or even single stocks.

In basketball there could be injuries, lack of momentum, or just simply bad luck that lead to a formerly successful team’s downfall. In the stock market, there are almost endless ways that could lead to a company’s downfall given the possibility of black swans (unforeseen events), economic issues, and more.

It is crucial as a long-term investor to stay dedicated to a prudent investment strategy that includes multiple asset classes that are non-correlated, show signs of quality prospects, and match your risk, timeline, and investment goals.

To learn more about how we consider asset classes and the “proper blend” of how we configure them, email us today to get started.

Thank you for reading this week’s “Making Sense with Ed Butowsky” article. To view the rest of Ed’s articles, you can click here or you can also check out Ed’s personal website to learn more about him.

To see the video of “The Starting 9” mentioned this week, click here to watch.

For more information, email Jordan McFarland at jordan@chapwoodinvestments.com.

Disclosure:

Neither Asset Allocation nor Diversification guarantee a profit or protect against a loss in a declining market. They are methods used to help manage investment risk. A REIT is a security that sells like a stock on the major exchanges and invests in real estate directly, either through properties or mortgages. REITs receive special tax considerations and typically offer investors high yields, as well as a highly liquid method of investing in real estate. There are risks associated with these types of investments and include but are not limited to the following: Typically no secondary market exists for the security listed above. Potential difficulty discerning between routine interest payments and principal repayment. Redemption price of a REIT may be worth more or less than the original price paid. Value of the shares in the trust will fluctuate with the portfolio of underlying real estate. Involves risks such as refinancing in the real estate industry, interest rates, availability of mortgage funds, operating expenses, cost of insurance, lease terminations, potential economic and regulatory changes. This is neither an offer to sell nor a solicitation or an offer to buy the securities described herein. The offering is made only by the Prospectus.

Chapwood Investments, LLC is a SEC Registered Investment Advisory Firm. No mention of a particular security, index, derivative or other instruments in this material constitutes an opinion on suitability of any security. The information and data in this material were obtained from sources deemed reliable. Their accuracy and completeness are not guaranteed. At any given time, principals at Chapwood Investments, LLC may or may not have a financial interest in any or all of the securities or instruments discussed in this material. The guests appearing in material do not receive compensation or provide endorsements or testimonials. Past performance is not indicative of any future results.